Campus Updates

February is Heart Month

Check out the latest about Heart Month events and helpful information to promote a healthy heart.

Winter weather information January 2026

There is potential for dangerous weather conditions that could impact UT Southwestern operations and our employees.

Winter weather awareness and safety tips

General tips and information about navigating the winter weather at and around UT Southwestern.

Winter weather awareness and safety tips

General tips and information about navigating the winter weather at and around UT Southwestern.

Prioritize your well-being this holiday season

Prioritize your well-being this holiday season with Headspace sessions.

Coming soon: AI platform launch and what to expect

Information about the implementation and responsible use of artificial intelligence (AI) at UTSW

A message from your SECC ambassador

Read a mid-campaign message from your SECC ambassador and see the photo gallery.

Cybersecurity Awareness Month 2025

October is Cybersecurity Awareness Month, a global effort to stay safe and protected when using technology and connecting online.

Digital accessibility compliance and training

Announcement about digital accessibility compliance and training.

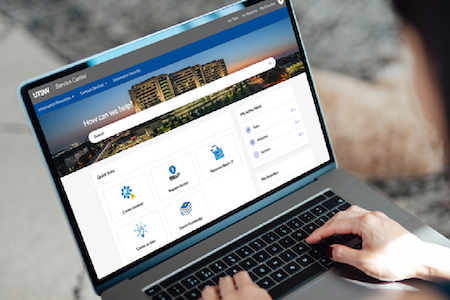

Now live: UTSW Service Center portal for your service request needs and more

The UTSW Service Center portal includes a vast knowledge base, sophisticated searching, a new ServiceNow catalog, and more.